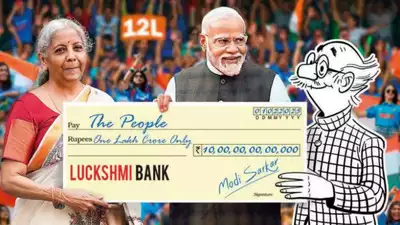

On Budget Eve, Prime Minister Modi invoked Goddess Lakshmi, and Indian taxpayers subsequently benefited from a sizable tax cut. The Finance Minister unveiled updated tax slabs, with the largest advantage going to individuals making up to Rs 12.75 lakh, who have no tax obligation. Refunds of up to Rs 60,000 and modified tax rates for different income categories are among the changes Union Budget 2025.

Indian taxpayers received a Diwali bonus in February after PM Modi invoked Goddess Lakshmi on Budget Eve. The biggest benefit is for those whose income is up to Rs 12 lakh (Rs 12.75 lakh for salaried taxpayers since they receive a standard deduction of Rs 75,000) as their liability will be zero under the new proposed income tax regime, which Finance Minister Nirmala Sitharaman announced along with revised tax slabs and rates. Capital gains and other types of income, however, are not included and will be subject to different short- and long-term tax rates Union Budget 2025.

Also Read :- Remote Mobile App Developer Free Internship For College Student Stipend Rs.10k Apply Now 2025

Also Read :- Remote UI/UX Designer Free Internship For College Student Stipend Rs.25k Apply Now 2025

Table of Contents

How did the FM arrive at this magical zero-tax amount, then? This was made possible by raising the tax refund from the current amount of Rs 25,000 to Rs 60,000. Due to a refund of up to Rs 60,000, the tax burden under the new system on income of Rs 12 lakh and Rs 12.75 lakh for salaried individuals is Rs 60,000. Therefore, there is no tax.Also see: Ten things that individual taxpayers ought to be aware ofHowever, what if your income exceeds Rs 12 lakh? You would not be eligible for a refund if your taxable income is even one rupee higher; instead, you will be required to pay taxes at slab rates under the new tax system. However, due to a change in tax slabs and standard Everyone will benefit from the new regime’s Rs 75,000 discount Union Budget 2025.

Union Budget 2025 chart

According to the rejig, individuals who make more than Rs 12 lakh annually would pay no tax on income up to Rs 4 lakh, 5% on income between Rs 4 and Rs 8 lakh, 10% on income between Rs 8 and Rs 12 lakh, and 15% on income between Rs 12 and Rs 16 lakh. Income between 16 and 20 lakh will be subject to 20% income tax, 20–24 lakh to 25% income tax, and beyond 24 lakh to 30% income tax annually. Your income level will determine how much you save (see chart). At an income level of Rs 24 lakh, the maximum benefit of Rs 1.1 lakh will be obtained, where the tax payable under The suggested plan would cost Rs 3 lakh, but the current new plan will cost Rs 4.1 lakh. Since the tax rate stayed at 30% beyond the Rs 24 lakh income threshold, the benefit will stay at Rs 1.1 lakh Union Budget 2025.

In the past, Rs 7 lakh was the income threshold for zero tax payments. Approximately 1 crore assessees who previously had to pay taxes ranging from Rs 20,000 to Rs 80,000 would now pay no tax as a result of raising this cap to Rs 12 lakh. The provision will result in a Rs 1 lakh crore loss in exchequer revenue Union Budget 2025.

Rates and slabs have not changed for individuals under the previous regime, which is typically utilised by people with house loans or HRA deductions.Returning to a topic that frequently leads to misunderstandings, what happens to those whose taxable income is somewhat more than Rs 12 lakh? To prevent individuals making slightly more than Rs 12 lakh from having post-tax earnings that are less than those earning Rs 12 lakh, the taxpayer would receive marginal assistance in these situations. For example, a person’s taxable income is Rs 12.10 lakh Union Budget 2025. Their tax due, computed according to tax slabs, would be 61,500 in the absence of marginal rebate. However, this taxpayer only owes $10,000 because of marginal relief. acceptable for earnings up to about Rs. 12.75 lakh. Regular tax slabs apply after this Union Budget 2025.

Leave a Reply